Money 20/20 USA featured many high-level sessions on the convergence of AI and Blockchain

If you read my last post, you may have had the same reaction as the legendary fintech blogger Chris Skinner. On the blog entitled "Fintechs New Power Couple: AI and Trust, he politely corrected, "AI, trust and DLT sir" as a comment on my post. As soon as I read his input I knew he was right. I had to write a follow up post, to correct my glaring omission.

As there are three forces converging here rather than two, I will update the title to make it both more contemporary, and more accurate at the same time ... Fintech's New Power Throuple is the convergence of AI, Trust, and Distributed Ledger Technology (DLT).

If I drew a diagram of the relationships between the three different factors I would put it in the form of a triangle . From my viewpoint Trust would hold the uppermost position, with Blockchain and Artificial Intelligence occupying the two lower positions. They are kind of the technology layer that makes that makes Trust possible. As Trust isn't a technology, or is it?

Build secure, compliant crypto wallets without touching private keys.

Dfns is the Wallets-as-a-Service platform trusted by teams at Stripe, MoonPay, Sphere, and global institutions like Fidelity, ABN AMRO, and Zodia Custody. With MPC-based architecture, SOC 2 and ISO certifications, and APIs built for developers, Dfns helps fintechs, exchanges, OTC desks, market makers, and DeFi platforms launch on-chain wallets across 50+ blockchains,without the headaches of key storage, policy enforcement, or compliance risk. Whether you’re scaling payments infrastructure or building a regulated digital asset platform, Dfns makes wallets work the way you need them to.

Request your demo now at fintechconfidential.com/dfns

The combination of these two data-driven technologies forms the intelligent ledger, which in a way is Trust. Integrated the two domains provide bonafide transaction data, and intelligent networks authenticating parties involved in the transaction. Trust is becoming a technology.

I could pontificate for hours about how smart contracts can be made smarter, and how immutable blockchain information can add to the veracity of data used with AI models. But, I'll leave you to come up with all the use cases, possibilities, and transactional gymnastics to harness the combined power of these three forces that are redefining digital payments.

I was politely corrected by legendary fintech blogger Chris Skinner how it was more than a couple

As if I needed further reinforcement; almost immediately after seeing Chris' comments, I ran across an article on Forbes focused on this very subject by Sandy Carter, who is the COO at Unstoppable, and a top 10 Microsoft MSN AI Entrepreneur. Her article entitled, "The Next PayPal? How AI And Blockchain Are Rewriting Digital Payments", focused on some of the companies that are innovating the future of digital dollars, and how they will be moved.

In the article she cites a report from Boston Consulting Group (BCG), which says global payments revenue is expected to reach $2.4 trillion by 2029, with agentic AI, digital currencies and real-time payments shaping the change. To show some of these shifts she shares information on three companies that she's had the chance to talk to recently. Bankr, Olas Pearl, and the fast-rising TON chat wallet ecosystem. It's a great read filled with profiles of up and coming companies, that are all doing fascinating things in this space.

In BCG’s 23rd annual Global Payments Report, The Future Is (Anything but) Stable, the authors draw on BCG’s proprietary Global Payments Model and include forecasts and market dynamics across more than 60 economies accounting for 90% of global GDP.

Build secure, compliant crypto wallets without touching private keys.

Your days of choosing between data security and data usability are over. Whether you're just concerned with PCI compliance or need to go further to include CCPA, GDPR, SOC2, and beyond, Sky Flow has you covered. What if you could build fast but not break privacy? With SkyFlow, you can. Visit SkyFlowSecure.com today to learn how.

It identifies five structural forces reshaping the payments landscape: the rise of agentic AI, digital currencies such as stablecoins, fintech disruption, real-time account-to-account (A2A) systems, and the enduring importance of cost transformation.

“This is a turning point for the industry,” said Inderpreet Batra, BCG managing director and senior partner and global head of the firm’s payments and fintech segment. “Traditional growth levers are losing force, but new drivers including agentic systems, programmable money, and fintech innovation are rapidly coming into focus. The players that align to these shifts now will lead the next decade.”

Combination of Artificial Intelligence and Blockchain will create a Trusted Intelligent Ledger

You don't need me to tell you cryptocurrency, stablecoins, tokens and all things Bitcoin are on the rise. After the dust has settled, the Wild West days of a bunch of wacky characters has become a more palatable and as a result more powerful financial technology.

Even traditional banks like JPMorgan Chase have said they will accept Bitcoin as an asset for collateral loans and such. The firm's leader, Jamie Dimon has not had a lot of nice things to say about cryptocurrency and Bitcoin in particular. However it looks like even the biggest is starting to change their perspective. It's interesting to watch, as AI becomes more widely accepted it seems like other frontier technologies are kind of coming along for the ride.

Transform Your Merchant Applications with Under. The Under platform revolutionizes how you handle merchant applications, offering a seamless transition to digital forms. Say goodbye to outdated processes and hello to efficiency. Discover the future of financial applications at https://under.io/ftc

Advertisement

Or are they driving the bus? According to Boston Consulting Group's research:

Agentic AI is set to influence over $1 trillion in e-commerce spending. 81% of US consumers expect to use agentic AI tools to shop, which will shape more than half of all online purchases in the near future.

Stablecoins reached $26 trillion in volume, although real-world payments account for only 1% of that total. The market remains heavily concentrated in facilitating crypto trading.

Payments fintechs generated $176 billion in revenue in 2024, and are growing at 23% annually. Payments-focused fintechs have attracted over $135 billion in equity funding over the past 25 years and now make up 45% of total fintech revenue. The top performers are growing three times as fast as incumbents.

Real-time A2A payment volumes rose 40% globally in 2024. These systems now account for around a quarter of digital retail payments worldwide, even exceeding 50% of transactions in selected markets like India and Brazil. In the Middle East and Africa, where real-time systems are still emerging, adoption is projected to reach more than 50% by 2030.

“We’re entering an era where growth and complexity go hand in hand,” said Markus Ampenberger , BCG managing director and partner. “The next winners in payments won’t just be fast adopters of technology. They will be the firms that deeply integrate new capabilities into business and operating models, and customer value propositions.”

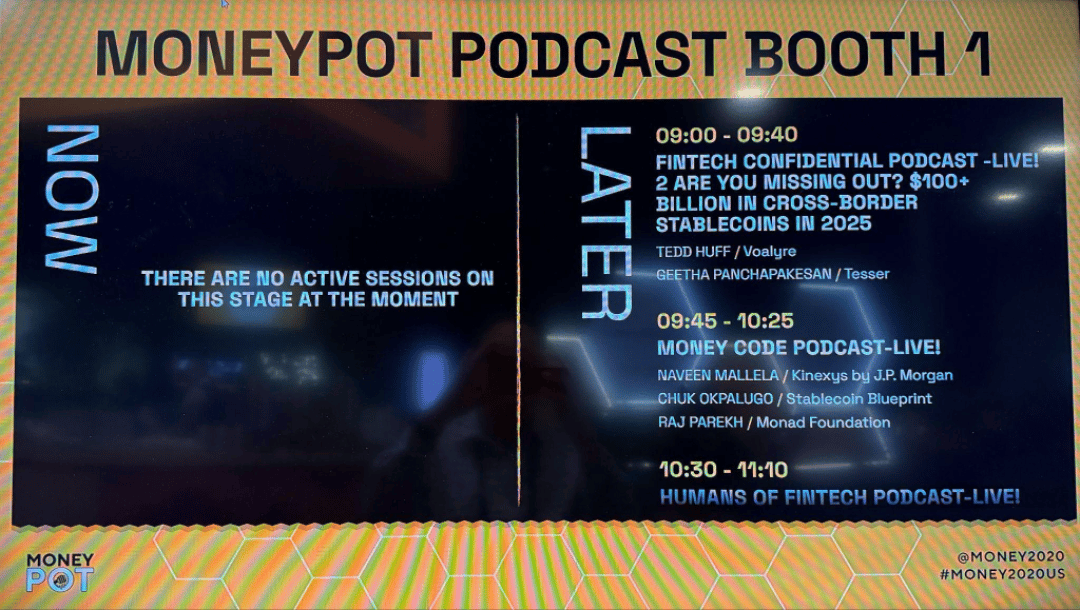

In the Honeypot Podcast Booth Tedd Huff Interviewed Geetha Panchapakesan, CEO of Tesser

Many of the exhibiting and presenting companies were laser-focused on integrating only AI into their existing or new fintech platforms, but others were throwing in the whole kit and caboodle. And there is no telling what could come out of this. This is a whole new era that we are living in. In a few years I don't think the landscape will look the same.

While I was interviewing some of the companies at Money 20/20 for Fintech Confidential, I changed one of the interview questions that I have been asking for years. I used to ask my guests to give me a prediction as to what the future looked like to them. Usually I'd ask what the next two to three years looked like and most interviewees could give me a pretty good picture of what to expect from them and / or the industry. But at Money 20/20 people were having a hard time predicting what was even going to happen in the next year.

Payments are going to be frictionless, for the most part it will be only an intention from us that will set off a series of processes we'll never see and we'll trust the outcome is perfect. If there is an issue AI agents will attend to it, resolving it, or floating it back to us if it needs further authorization or input. Money will be more like the tokens that large language models use to tally the amount of compute that you are utilizing. It will have any input and output tally the same way that AI models do. Sam Altman said that compute is going to be the next currency. With the way things are going, I'm starting to believe him - everyone will use it.

HAWK:AI - HAWK:AI's game-changing approach to compliance. With real-time monitoring, adaptive learning, and advanced AI, it cuts false positives, simplifying your compliance efforts. Upgrade your surveillance with ease. Visit https://gethawkai.com for more intelligent, more effective compliance.

Advertisement

The Tuesday Night Industry Party at Money 20/20 in the Voltaire Lounge

So those are some general predictions about what I see coming. I myself am commoditizing tokens and making the world's best large language models available to those who do not have the credit cards, bank accounts, and financial infrastructure necessary to gain access to artificial intelligence. My Instant AI removes the barriers caused by the requirements of the traditional financial system. We are democratizing artificial intelligence because it's not a real revolution if everyone doesn't have access. It's just an invention for the haves of society.

Citizens in the emerging markets need a miracle more than most. AI can affect change in a persons life, far greater than any mobile financial service could ever muster. Orchestrating further integration with blockchain, could build even more trust with the platform users.

Their purchase history, current status and all transactions could exist on-chain and they would document the consumers usage, growth, and much more. It would benefit both the end user and my company. I hope you know I am discovering this concept right along with you as I am typing it. I never had this thought before. But we do have a digital wallet that tracks the users tokens so why not a blockchain wallet? Is it overkill? I guess that depends on the scale of the My Instant AI platform. But it's definitely something to think about.

Transform Your Merchant Applications with Under. The Under platform revolutionizes how you handle merchant applications, offering a seamless transition to digital forms. Say goodbye to outdated processes and hello to efficiency. Discover the future of financial applications at https://under.io/ftc

Advertisement

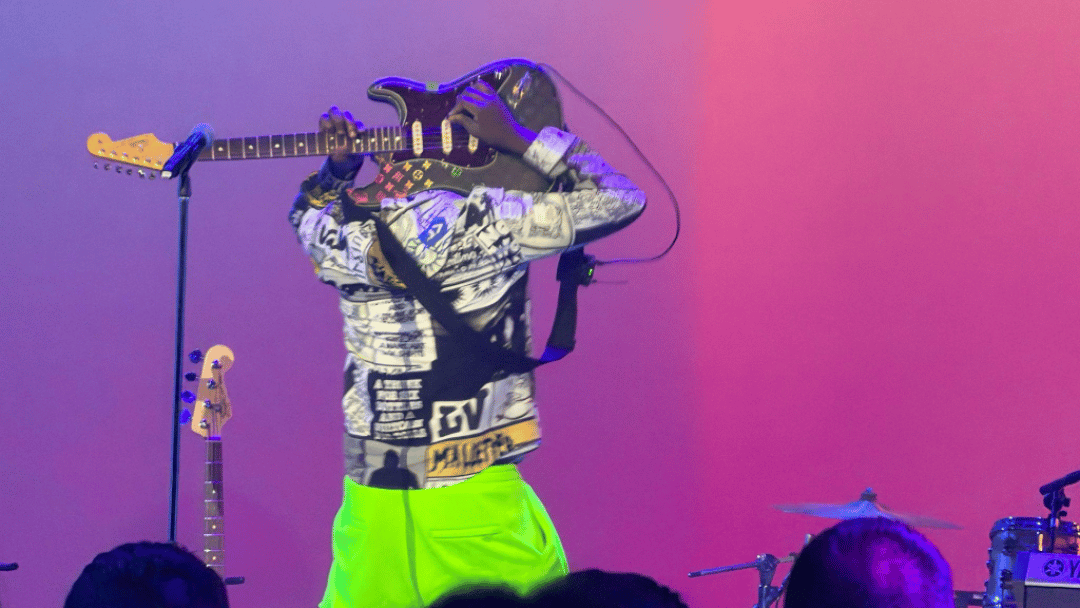

Wyclef Jean plays his Louis Vuitton embossed guitar behind his head at Money 20/20

So there you have it, talking about what's coming next I may have discovered a use for it myself. Can I combine blockchain with AI to earn more trust from our users? Will immutable records build a firm belief in the reliability, truth, ability, or strength of our product platform? You could, and probably should run this same kind of self-assessment on your fintech product and/or platform. Can you combine AI, Trust and DLT in your products and services?

It's not really difficult, and you take it even further in a brainstorm session with your colleagues. Either individually or as a group, include your favorite AI to open some unseen ideas. It might be a source of untapped revenue, or create a better experience for your customers. When you open your mind into the realm of all possibilities you can discover new things. The same way all these early entrants mentioned in the articles have done.

Could you and your customers use an intelligent ledger that kept track of every single token, transaction, and move money so flawlessly that you never even have to think about it. Costs are reduced, loyalty accelerates, and bird nest's of red tape is a thing of the past. I think you owe it to yourself to read Sandy's article, and download BCG's report. Study it and then start planning your next move in this new era. The convergence of artificial intelligence, trust and distributed ledger technology is the perfect blend of brains and blockchain.

Does the future of money resemble a honeycomb of AI, Trust and DLT?

DD3 Media is a media creation, management, and production company delivering engaging content globally